What Is a Credit Report?

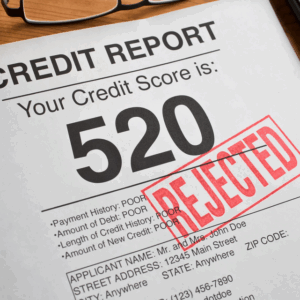

A credit report captures the financial behaviors lenders care about most. It is a detailed record of how you’ve borrowed and repaid money over time. Credit bureaus—Equifax, Experian, and TransUnion—compile this data from creditors, collection agencies, and public records. Each report may vary slightly, but all collect similar categories of information.

Core Components of Your Credit Report

Each section of your credit report builds a picture of your financial habits. Here’s what you’ll find:

- Personal Information: Includes your name, Social Security number, past and current addresses, date of birth, and employment history.

- Credit Accounts (Tradelines): Lists open and closed accounts like credit cards, auto loans, mortgages, and student loans, with details such as credit limits, balances, and payment history.

- Credit Inquiries: Highlights any time a lender runs a hard inquiry when you apply for credit. Soft inquiries, such as preapprovals, appear but don’t impact your score.

- Public Records: Displays bankruptcies, foreclosures, liens, or judgments collected from public court records. Only negative public records appear.

- Collections: Debt sent to collection agencies is listed separately and can significantly impact your score.

Where Credit Bureaus Get Their Information

Lenders report your account activity to one, two, or all three major credit bureaus. This information sharing isn’t required by law; it occurs voluntarily and varies by lender. Utility companies, landlords, and smaller financial institutions may not report at all.

In addition to lender reports, credit bureaus pull from public records and third-party data aggregators. For example, if a civil judgment was filed against you in court, it may appear on your report even if the lender didn’t notify the bureau directly.

How Credit Scores Are Calculated: FICO and VantageScore Models

FICO and VantageScore dominate the credit scoring landscape. Although their formulas differ slightly, both emphasize similar factors in determining your score, which ranges from 300 to 850.

- Payment History (35% FICO / 40% VantageScore): Considers late payments, defaults, and bankruptcies. Even one missed payment can trigger a drop of over 100 points, depending on your prior credit standing.

- Amounts Owed/Credit Utilization (30% FICO / 20% VantageScore): Compares your credit card balances to your limits. A utilization rate above 30% lowers your score; staying under 10% produces stronger results.

- Length of Credit History (15% FICO / ~21% VantageScore): Factors in how long your accounts have been open. Older accounts in good standing add value.

- New Credit/Hard Inquiries (10% FICO / ~11% VantageScore): Submitting multiple applications within a short span can signal a higher risk. Rate shopping for loans within a 14-45 day window typically counts as one inquiry.

- Credit Mix (10% FICO / ~18% VantageScore): Reflects the variety of credit types in your profile—revolving (credit cards) and installment (loans). A well-balanced mix improves your score.

Credit reports feed the score. The score predicts behavior. Clean up the report, and the score will follow. Ready to take a peek at your own? That’s the next step.

Track Your Credit Like a Pro: Why Regular Monitoring Matters

Stay Ahead With Consistent Credit Report Monitoring

Your credit report tells the story of your financial habits, and creditors, lenders, and even landlords are reading closely. Monitoring it regularly gives you control over that narrative. Spot errors before they damage your score. Catch signs of identity theft before they spiral. Track your progress as your responsible habits shape a stronger financial profile.

Your credit report tells the story of your financial habits, and creditors, lenders, and even landlords are reading closely. Monitoring it regularly gives you control over that narrative. Spot errors before they damage your score. Catch signs of identity theft before they spiral. Track your progress as your responsible habits shape a stronger financial profile.

Access Your Reports — No Strings Attached

You’re entitled to one free credit report per year from each of the three major bureaus: Equifax, Experian, and TransUnion. That’s three reports annually, at no cost. Visit AnnualCreditReport.com — the only federally authorized source — and take advantage of this right.

Since 2020, the site has offered weekly free reports as a temporary pandemic support measure, and as of early 2024, many users continue to report accessing the reports every week. Please check the site directly to confirm the current frequency.

Set Up Smart Alerts That Work for You

Many banks, credit card issuers, and third-party financial tools offer customizable alerts linked to changes in your credit report. Choose notifications for:

- New account openings

- Hard inquiries from lenders

- Missed payments or delinquent remarks

- Sudden changes in account balances

These notifications create an early warning system. One unexpected alert can tip you off to fraud or a reporting error — fast action minimizes damage.

Accuracy Isn’t Optional — Scrub Your Report for Mistakes

Incorrect information in your credit file can lower your score by dozens, even hundreds, of points. A 2021 study from the FTC found that 26% of participants spotted at least one potentially material error on their credit reports. That’s more than one in four people.

Scan every line, including account numbers, dates, balances, payment history, credit limits, and personal data such as your name and addresses. An inaccurate late payment or unfamiliar account deserves immediate follow-up. The work starts here — but it pays in real results.

Correcting Credit Report Errors to Boost Your Score

Common Types of Errors Found on Credit Reports

Credit reports don’t always get it right. According to a 2021 study by the Federal Trade Commission (FTC), 1 in 5 consumers had an error on at least one of their credit reports. These inaccuracies can drag down your score without you realizing it. Recognizing specific error types helps you focus your review.

- Incorrect personal information – Names, addresses, or social security numbers that don’t belong to you.

- Wrong account details – Accounts listed with incorrect limits, balances, or payment histories.

- Duplicate accounts – The same loan or credit card is listed more than once, creating the illusion of more debt.

- Outdated negative items – Collections or late payments that should have expired after the 7-year reporting period.

- Fraudulent accounts – Lines of credit opened by someone else in your name, often a result of identity theft.

How to Dispute Incorrect Information with the Credit Bureaus

Submitting a dispute requires precision and documentation. The process typically begins online, but can also be done by mail. Each bureau—Equifax, Experian, and TransUnion—has its dispute procedure. Here’s how to start:

- Request a copy of your credit report from AnnualCreditReport.com.

- Highlight the error clearly and gather relevant documentation, such as billing statements or identity verification records.

- File a dispute directly with the bureau reporting the error. Use their online portals or send a letter by certified mail.

- Explain why the item is incorrect and include copies of documentation supporting your claim.

- The bureau has 30–45 days to investigate and must notify you of the results in writing.

If the data furnisher (the lender or creditor) confirms the item is inaccurate, the bureau will amend or remove it. If they claim it is correct, you can still add a statement of dispute that remains on your report.

How Fixing Errors Can Quickly Improve Your Credit Score

Once a bureau corrects or deletes inaccurate negative items, the change is reflected within one cycle, and that update can produce immediate score gains. For example, removing a collection account or falsely reporting a late payment can increase a FICO score by 20 to 100 points, depending on your overall credit profile. The most significant jump often comes when the error is the only derogatory item on a relatively clean report.

Have you reviewed your reports this year? If not, the next few minutes could uncover inaccuracies that cost you points—and money.

Build a Strong Payment History That Lifts Your Credit Score

Payment History Drives 35% of Your FICO Score

More than a third of your FICO credit score—exactly 35%—relies on your payment history. No other factor carries more weight. Lenders examine how reliably you’ve paid credit cards, auto loans, mortgages, and other debts. A track record of on-time payments signals financial responsibility and dramatically increases your chances of qualifying for credit at lower interest rates.

Make Timely Payments Every Time

A payment history isn’t about being perfect over the years—it’s about staying consistent from month to month. One late payment, reported 30 days or more after the due date, can drop your credit score by 60 to 110 points, depending on your overall credit profile. That impact doesn’t fade immediately; major delinquencies stay on your credit report for up to seven years.

To build reliable habits, use strategies that eliminate guesswork:

To build reliable habits, use strategies that eliminate guesswork:

- Pay at least the minimum due each month. More is better, but consistent minimum payments prevent derogatory marks.

- Align bill due dates with your pay schedule to ensure timely payments. Call your creditor and request a different due date if your current date conflicts with your income flow.

- Tackle smaller balances first. Psychologically, this builds momentum, and every account in good standing helps your score.

- Use Alerts and Automation to Stay on Track

Manual tracking works until it doesn’t. The better approach is automation. Start with autopay for fixed payments, such as car loans or installment plans. For variable bills, set calendar alerts five days ahead of due dates or use mobile banking notifications.

Consider this mix for maximum coverage:

- Enable autopay for minimum payments to prevent missing deadlines

- Set weekly reviews on your budget app to verify that all bills are covered

- Use spreadsheet trackers for debt payments with irregular schedules

- Avoid the Fallout from Missed or Late Payments

Once a payment becomes 30 days late, lenders can report it to the credit bureaus. At 60 or 90 days overdue, the damage becomes more severe. Accounts may be moved to collections, which can further damage your profile. Lenders view this as a red flag, which can lead to increased interest rates, declined applications, or reduced credit limits.

Even when life gets hectic, prioritizing on-time payments will boost your credit score and open up better financial opportunities. Miss a deadline once? Pay it as soon as possible within the 30-day window, and the damage stays off your credit report entirely.

Slash Your Credit Utilization Ratio to Boost Your Score

What Credit Utilization Reflects—and Why It Matters

Credit utilization measures the percentage of your available revolving credit that you’re currently using. It’s calculated by dividing your total credit card balances by your total credit limits and multiplying the result by 100. If your combined limits across credit cards equal $10,000 and your balances total $3,000, your credit utilization rate stands at 30%—right on the edge of what’s considered acceptable by most scoring models.

This ratio accounts for roughly 30% of your FICO credit score. Among the five score components, only payment history weighs more heavily. High utilization signals potential financial stress and increases the risk profile in the eyes of lenders. Keeping this percentage low demonstrates responsible credit management and positively influences your score.

Target Credit Utilization: Stay Under 30%

Credit scoring models reward discipline. To optimize your credit score, aim to maintain your utilization below 30%. However, staying well under that threshold—around 10%—delivers stronger results. For example, if your available credit totals $15,000, keeping your balance under $1,500 positions your profile for better scoring outcomes.

Note that scoring algorithms evaluate both individual card utilization and overall usage. A single card maxed out—even if your total ratio remains low—can produce an adverse scoring effect. Spreading balances proportionally or paying off cards entirely neutralizes this risk.

Lowering Utilization Enhances More Than Just Your Score

Reducing your balances doesn’t just improve your score—it increases your financial flexibility. Lower utilization means more available credit in case of emergencies and lowers the interest burden you carry each month. Over time, this translates to fewer finance charges and more cash preserved for meaningful goals.

Many consumers see score improvements within a billing cycle or two after paying down revolving debt. Want to see it in action? Log in to your credit card portal and analyze how your credit usage has changed over the last three months. Then observe how those adjustments translate into score movements by checking your credit monitoring service.

Stay Ahead of Due Dates: Avoid Late Payments by Staying Organized

Late payments can quickly damage your credit score. According to FICO, payment history accounts for 35% of your score. A single missed payment—reported after 30 days past due—can knock off 90 to 110 points from a good credit score. Keeping your finances organized prevents these hits and helps maintain momentum toward a stronger credit score.

Use Digital Tools to Keep Everything on Schedule

Digital solutions eliminate guesswork. Calendar apps like Google Calendar or Apple Reminders allow you to set recurring alerts days in advance of a bill due date. Many banking apps now offer customized notifications as well. Want something more comprehensive? Expense management tools like You Need a Budget, Mint, or PocketGuard track due dates, account balances, and spending trends in one view.

- Set auto-reminders: Configure push notifications or emails to be sent a few days before the due date.

- Use automated payments selectively: Set up auto-pay for fixed expenses, such as loans or insurance, while managing variable payments, like credit cards, manually to avoid overdrafts.

- Sync with your paycheck: Align payment cycles with your income schedule to maintain better cash flow visibility.

Link Payments Directly to Your Budget

Deadlines alone won’t help if there’s no money behind them. That’s where budgeting comes into play. Integrating payments into a working budget ensures that each bill is placed within its financial context. Allocate specific funds for each obligation when income hits your account—this ensures that when due dates arrive, you’re ready.

Using zero-based budgeting or the envelope method creates tightly controlled spending categories, ensuring a clear understanding of expenses. Each payment, rent, or revolving credit claims its space in the plan, removing surprises later.

Facing Trouble? Talk to Your Lender—Not After the Fact

When money’s tight, silence helps no one. Lenders offer temporary relief options, such as deferment, payment plans, or waived late fees, but they require advance notice. Call before the due date passes. Document the call, request confirmation in writing, and follow up accordingly.

- Request updated due dates: Some lenders allow changes to avoid mismatches with paydays.

- Explore hardship programs: Credit card issuers may temporarily reduce minimum payments or interest.

- Avoid delinquency reporting: A proactive agreement can stop late submission to credit bureaus altogether.

Organization doesn’t mean complexity. Whether it’s a notepad, a spreadsheet, or a whole financial app ecosystem, what matters is consistency. Use what fits your habits, stay alert to upcoming bills, and create a rhythm that leaves no payment behind.

Think Before You Apply: How Limiting Hard Inquiries Can Improve Your Credit Score

Hard vs. Soft Inquiries: What’s the Actual Impact?

Every time you check your credit, nothing changes. These checks are known as soft inquiries—they don’t affect your credit score and aren’t visible to lenders. Soft pulls happen when you:

- Review your credit report

- Receive a pre-approval offer from a lender

- Undergo a background check for employment

Hard inquiries, on the other hand, show up the moment a lender evaluates your credit for a new account. Think credit cards, auto loans, or mortgages. These checks signal to credit scoring models that you’re actively seeking credit, and they can lower your credit score by up to five points each, according to FICO. Though a slight dip, it adds up if you apply for several products in a short time.

Stacking Applications = Stacking Damage

Multiple applications made over a short period can amplify the impact. Credit scoring models, including both FICO and VantageScore, take into account the number and timing of hard inquiries. Here’s what happens:

- Each hard inquiry remains on your credit report for 24 months, although the score typically rebounds after 12 months.

- Inquiries made within a short window for the same type of loan—such as a mortgage or auto loan—are treated as a single inquiry (usually within 14 to 45 days, depending on the scoring model).

- Spaced-out inquiries for different types of credit can signal risk and make you appear financially unstable.

Lenders may interpret frequent applications as a red flag, suggesting financial distress or poor planning. That perception hurts your approval odds and the terms of your interest.

Best Practices Before You Say Yes to a New Credit Check

Before you let a lender pull your credit, ask yourself: Do I need this new account right now? Do I have a strategy for managing it? Practice these habits to minimize brutal inquiry fallout:

Before you let a lender pull your credit, ask yourself: Do I need this new account right now? Do I have a strategy for managing it? Practice these habits to minimize brutal inquiry fallout:

- Plan and research before applying. Compare lenders without allowing multiple pulls. Use tools that show estimated approval odds.

- Limit credit applications to essential times. Apply only when you’re confident in approval, and avoid casual applications “just to see.”

- Cluster rate-shopping inside a scoring window. Need a mortgage or auto loan? Complete all applications within two weeks to ensure hard pulls count as one.

- Monitor your credit before applying. Knowing your score range and report content boosts your chances and reduces unnecessary checks.

- Avoiding hard inquiries isn’t about fear—it’s about focus. Lenders check your history for signs of risk; limiting inquiries helps you tell a better story.

Boost Your Score by Raising Limits — Without Raising Debt

Drive Down Your Utilization Ratio Strategically

Your credit utilization ratio measures how much of your available credit you’re using. Since this factor contributes up to 30% of your FICO credit score, optimizing it delivers measurable results. By increasing your credit limit while keeping your spending steady—or better yet, reducing it—you decrease your overall utilization, which significantly lifts your score.

Here’s how it works. Suppose you have a credit card with a $4,000 limit and a $2,000 balance. Your utilization sits at 50%. If your limit climbs to $6,000 and your balance remains unchanged, utilization drops to 33%. That single shift can push your score up by tens of points within a single billing cycle.

How to Request a Credit Limit Increase

- Wait for the optimal moment: Aim to request an increase after six months of consistent, on-time payments, especially if your income has improved.

- Gather your numbers: Have recent income figures, monthly housing payments, and employment information ready. Card issuers often request these details to assess risk.

- Use online portals first: Most major credit card issuers—such as Chase, Capital One, and American Express—offer self-service tools in their online dashboards to request increases easily.

- Be direct and concise in your contact: If you call, clearly state that you want an increase without making a hard inquiry. This sets the tone and parameters for the conversation.

How to Avoid a Hard Inquiry When Asking

Not every credit limit increase triggers a hard inquiry, but some do, and that can temporarily dent your score. Before hitting “submit” or confirming by phone, ask just one question: “Will this request trigger a hard inquiry?” If the answer is yes, choose to pause and revisit the request at a later time or try a different issuer. Some lenders—such as Capital One or Discover—typically review internal account history only, thereby avoiding a hard pull altogether.

This approach works only when paired with restraint. An increased limit only helps if spending doesn’t scale to match it. Hold the line, and your report will reflect a lower risk almost immediately.

Rebuild Your Credit with a Secured Credit Card

What Sets a Secured Credit Card Apart

A secured credit card typically requires a cash deposit upfront, equal to the credit limit. For example, a $300 deposit typically secures a $300 credit line. This deposit reduces the risk for the issuer, making secured cards accessible for people with low or no credit scores.

Credit card activity is reported to the major credit bureaus—Experian, Equifax, and TransUnion. That reporting mechanism turns this basic financial tool into a credit-building engine when used consistently and wisely.

Who Benefits from a Secured Card?

First-time borrowers who need to establish a credit history from scratch.

Individuals recovering from bankruptcy or past delinquencies.

Immigrants and international students without U.S. credit histories.

If you’re in one of these groups, approval odds for a secured card are significantly higher compared to unsecured credit cards. According to the Consumer Financial Protection Bureau, secured cards have approval rates of over 80% for individuals with poor credit, compared to less than 30% for traditional cards.

Cut Through the Noise: Use It the Right Way

Keep purchases small—think gas or groceries. A recurring charge of $25 to $50 works well.

Always pay your balance in full by the due date. This eliminates interest charges and builds trust with the issuer.

Never max out the limit—even if it’s low. Keep utilization under 30% to maximize score gains.

Let’s say you have a $300 limit. Charging $90 or less per billing cycle keeps your utilization ratio in the optimal range. Make your full payment before the statement closes to show a zero balance.

Graduating to an Unsecured Credit Card

After six to 12 months of responsible use, many issuers offer automatic upgrades to unsecured cards or a refund of your original deposit. Some, like Capital One and Discover, periodically reassess your credit profile and may even increase your credit limit without requiring additional funds from you.

Once you upgrade, the positive payment history transfers with you. That single step significantly enhances your creditworthiness in the eyes of lenders, making lower interest rates and better loan terms more accessible.

Let Time Work in Your Favor: Keep Older Credit Accounts Open

How Credit History Length Impacts Your Credit Score

FICO, which dominates the U.S. credit scoring industry, assigns 15% of your credit score to the length of your credit history. While not the most significant factor, it carries real weight. The longer you’ve maintained credit accounts in good standing, the more points you’ll earn in this category.

Lenders view long-standing accounts as proof of experience managing credit responsibly. A credit card opened 12 years ago that’s never missed a payment tells an entirely different story than one opened three months ago. Credit scoring models reward consistency across years, even decades. The average age of your accounts, as well as the age of your oldest account, both influence this portion of your score.

Why Closing Old Accounts Can Hurt Your Score

When you close an old credit account, you’re deleting its age from your active credit file. While the account history will remain on your report for up to 10 years, scoring models calculate the average age of open accounts. If that closed account was your oldest, expect the average age of your accounts to drop, along with your credit score.

There’s also an indirect impact. Closing a credit card reduces your total available credit, which can cause your credit utilization ratio to spike. That ratio — which tracks how much of your available credit you’re using — makes up 30% of your FICO score. High utilization can quickly drag your score down.

When It’s Okay and Not Okay to Close a Credit Account

Okay to close: If the card charges an annual fee you’re no longer willing to pay, and it’s not your oldest account, then it’s okay to close. Or if the credit line is very recent and minimal, with no real impact on your credit profile. You can also close accounts carrying high interest if you’re not using them, but only if it won’t significantly raise your utilization ratio.

Not okay to close: If it’s your oldest card by several years, keep it open. Also, avoid closing multiple cards at once. The combined loss of available credit and age history can result in a significant score drop.

Try using older cards sparingly — maybe once every few months — and paying them off immediately. This keeps them active in the eyes of issuers without risking debt or fees. Unused cards that remain dormant for too long may be automatically closed by the issuer, which has the same consequences as closing them yourself.

Instead of trimming your credit history, build around it. Let those older accounts bolster the rest of your profile. Wondering how long is long enough? The average FICO high achiever (with scores above 800) has an account with 20 or more years of history. How close are you to that mark?

Expand Your Credit Horizons: Diversify Your Credit Mix

What Lenders See in Your Borrowing Variety

Credit scoring models, including FICO and VantageScore, factor in your credit mix, specifically the diversity of accounts under your name. This category contributes about 10% to your FICO Score. While a smaller slice compared to payment history or credit utilization, it still plays a part in shaping a strong credit profile.

Two broad categories dominate the landscape:

- Revolving Credit – Credit cards, retail cards, and lines of credit that let you borrow up to a limit and pay down debt monthly while carrying balances forward.

- Installment Loans – Fixed-term loans such as auto loans, student loans, mortgages, and personal loans that you repay in regular, scheduled payments.

Many consumers rely heavily on revolving credit—especially credit cards—without establishing a history of responsibly managed installment debt. The absence of variety makes your credit behavior less predictable to lenders, particularly for large loans like mortgages.

How Diversity Reinforces Your Credit Profile

Scoring models reward borrowers who demonstrate they can handle multiple types of credit responsibly. A mixed credit portfolio indicates financial maturity and a balanced approach to debt management. When you combine timely payments on both revolving and installment accounts, the result is a more robust representation of your reliability. This, in turn, improves scoring outcomes over time.

For example, someone who has managed a car loan, a student loan, and one or two low-limit credit cards is likely to score better in this category than someone with five credit cards and no loans, assuming all other factors are consistent.

Steps to Broaden Your Credit Mix

Consider a small personal loan if you’ve only used credit cards as a means of borrowing. Credit unions or online lenders often extend these to borrowers with limited credit histories.

Consider a small personal loan if you’ve only used credit cards as a means of borrowing. Credit unions or online lenders often extend these to borrowers with limited credit histories.

If you don’t have a car loan or mortgage, review your medium- and long-term needs. Financing a vehicle or taking out a credit-builder loan can add installment depth to your profile.

Consider a retail credit card or gas card if all your revolving accounts are with major banks. These carry lower credit limits, but diversify your sources of revolving credit.

The goal isn’t to open unnecessary accounts, but to create a track record that shows competency across a range of financial tools. Does your credit profile reflect versatility, or is it narrowly defined? The answer can nudge your score in either direction.

Get Expert Guidance: Work with Credit Counselors if You Need Support

When managing debt feels overwhelming or progress toward a better credit score has stalled, a certified credit counselor can provide structure and relief. These professionals assess your financial situation objectively, develop actionable strategies tailored to your goals, and serve as accountability partners throughout the process.

What Does a Credit Counselor Do?

Credit counselors specialize in consumer finance and offer personalized advice to help individuals manage debt, build savings, and improve credit. They typically operate through nonprofit organizations and begin with a comprehensive review of your income, expenses, and outstanding debts.

Here’s what you can expect during a standard counseling session:

- Budget assessment: Counselors analyze your monthly finances to determine realistic ways to reduce expenses or reallocate spending.

- Credit report review: They walk through your credit report, flagging issues and identifying opportunities for improvement.

- Debt management planning: If needed, they can create a debt management plan (DMP) that consolidates eligible debts into a single monthly payment with lower interest rates.

Customized Plans to Rebuild Credit

A credit counselor won’t just hand you generic advice. By working through your specific income level, obligations, and goals, counselors design a step-by-step roadmap that could include:

- Recommendations for which accounts to prioritize for payment

- Plans to reduce high-interest debt strategically over time

- Suggestions for improving your credit utilization ratio

- Timelines for financial milestones like qualifying for a mortgage or refinancing a loan

Unlike automated tools, this plan evolves. Regular check-ins allow for adjustments based on your progress or life changes.

Choosing the Right Credit Counseling Agency

Not all counselors offer the same level of support, and some charge hidden fees. To avoid scams or low-quality services, choose organizations accredited by nationally recognized oversight bodies.

NFCC (National Foundation for Credit Counseling): Established in 1951, the NFCC is the oldest nonprofit financial counseling organization in the U.S. Their member agencies must meet rigorous certification and compliance standards.

HUD-approved housing counseling agencies: These agencies are authorized by the U.S. Department of Housing and Urban Development to provide assistance with foreclosure prevention, home buying, and credit issues. They often offer services at no cost or a low cost.

Wondering how to find a certified credit counselor in your area? Start by visiting the NFCC website (nfcc.org) or searching for HUD-approved agencies at hud.gov. Enter your zip code to connect with an advisor who understands your regional financial trends and lending practices.

Let Time Work in Your Favor: Healing Your Credit the Steady Way

Negative information on a credit report doesn’t last forever. Over time, its impact fades—how quickly depends on the type of derogatory mark. Lenders and credit scoring models both place more weight on recent behavior than old mistakes. This creates a natural path to recovery: by making good choices, time will gradually reduce the damage.

How Long Negative Marks Stay on Your Credit Report

Credit bureaus follow strict timeframes for how long negative entries remain on your credit report, as regulated under the Fair Credit Reporting Act (FCRA). Here’s what you can expect:

- Late Payments: These remain for seven years from the original delinquency date. A single missed payment might drag down your score significantly, but its effect diminishes after 12 to 24 months of consistent on-time payments.

- Collections: Accounts sent to collections also stick around for seven years. Paid collections may show differently depending on the scoring model used—FICO 9 and VantageScore 4.0 don’t penalize for paid collection accounts.

- Chapter 13 Bankruptcy: Removed after seven years from the filing date.

- Chapter 7 Bankruptcy: Remains for 10 years.

- Hard Inquiries: These impact your score for only 12 months but stay visible for two years.

As each of these items ages, its effect on your score steadily weakens. A collection account from five years ago doesn’t carry the weight of one from six months ago. Time alone can’t repair credit, but paired with responsible credit use, it plays an essential supporting role.

Building a Consistent, Positive Credit History Over Time

Recovery from credit damage doesn’t involve mystery tactics or quick fixes. It requires measurable, repeated actions that signal stability. This includes paying every bill on time, maintaining low credit card balances, and resisting the urge to open unnecessary new accounts.

FICO and VantageScore both factor in historical behavior more than isolated moments. That means a solid track record will earn rewards. For instance, credit users who go 24 months without late payments typically see notable score improvements—even if old delinquencies still appear on their reports.

Now consider: Are your current credit habits telling the right story to your future lenders? If so, with each passing month, the past matters less, and your upward trajectory becomes clearer.

Own Your Credit Journey and Build the Financial Future You Want

Your credit score reflects the cumulative story of your financial behavior—payments made on time, debts reduced, accounts maintained with care, and decisions handled with foresight. Every action you’ve chosen so far has shaped that number, and every action you take next will continue to influence it.

Start with these core practices:

- Check your credit report regularly and identify inaccuracies that could be holding you back.

- Dispute errors as soon as they appear—correcting a single mistake can shift your score upward.

- Keep payments consistent and on time. Even one missed due date can lower your score for months.

- Lower your credit utilization by paying down revolving balances and spreading usage across multiple cards.

- Maintain long-standing accounts and diversify your credit types when appropriate.

These steps build upward momentum. As you stay vigilant—reviewing your reports, monitoring your progress, and resisting impulse-driven financial decisions—you establish a sustainable rhythm of control. Credit scores tend to rise with consistency and patience, but they also respond quickly to discipline, especially when paired with innovative tactics such as balance reduction and improved utilization management.

Every credit report update offers feedback. Use that data. Ask: Did your score rise? Did your debt load shrink? Are you trending in the direction you want to go?

There’s no finish line here. Financial life evolves—jobs change, goals shift, lenders update criteria. But credit management remains a foundational skill. Master it, and doors open: lower loan rates, better terms with lenders, faster approval on housing, and more room to negotiate. This is how financial freedom gets built—consciously, actively, and one decision at a time.

Contact us for more information or if you have questions!