February 21, 2019

Shawn Lane

Consumer Credit Expert

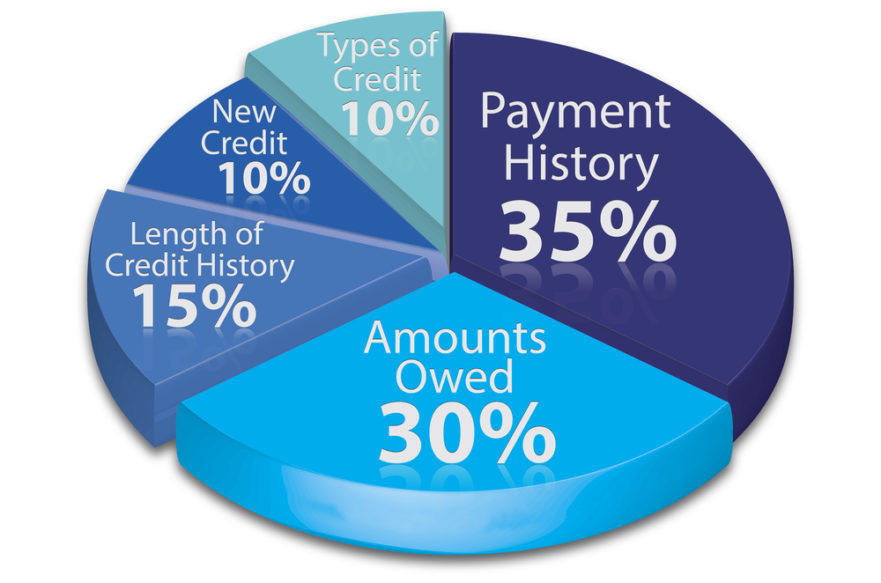

Many people think that paying your financial obligations on time is all it takes to earn great credit scores. The truth, however, is that credit scoring is more complicated than that. Believe it or not, the majority of the points in your credit scores don’t have anything to do with how you pay your bills.

The FICO Five

FICO Scores, the leading brand of credit scores used by major lenders in the U.S., are calculated based upon five different categories. The information considered within these five categories is all listed on your three credit reports.

Generally, if information is absent from your credit reports, it’s irrelevant as far as your credit scores are concerned. This means you know where to look when searching for ways to improve your credit scores — your credit reports themselves.

Learning how to earn the most points possible in each of the five FICO credit scoring categories is key if you want to earn and keep great credit.

Amounts Owed

The “Amounts Owed” category of your credit reports has a big influence over your credit scores. In fact, it’s only slightly less important to your scores than your payment history itself.

The amounts you owe on your outstanding debts determine 30% of your FICO Scores. Certain debts (like installment loans) won’t do much damage to your credit scores, even if the balances on those accounts are high. Yet if you are revolving large credit card balances from month to month, you might have a problem.

What Matters in the Amounts Owed Category?

FICO considers a variety of factors when evaluating the amounts owed category of your credit reports. Here’s a look at some of the information which matters most.

- The Revolving Utilization Ratio on Your Individual Credit Card Accounts

- The Total Revolving Utilization Ratio on All Your Credit Cards Combined

- Your Number of Accounts with Outstanding Balances

- How Much You Owe on All Your Accounts Combined

Revolving Utilization and Why It Matters Most

Your revolving utilization ratio is the most important factor FICO considers within this credit scoring category. Revolving utilization is a term which describes the percentage of your available credit card limits which you are using.

Here’s an example of how revolving utilization works. If you have a credit card with a $5,000 limit and a balance of $2,500, you’re “utilizing” 50% of your credit limit. Your revolving utilization ratio is 50%.

Credit scoring models are designed to reward you with more points when your credit reports show lower levels of credit card utilization. On the other hand, if your credit card utilization goes up, the impact upon your credit scores could be bad.

Action Items

“Amounts Owed” often represents one of the easiest categories where you can try to improve your credit scores. Here are a few action items to consider.

- Pay down your credit card balances.

If you can afford to do so, paying off your credit cards may be a great way to give your credit scores a boost. At the very least, paying down your credit card debt may save you money on expensive interest fees.

Even if paying off all of your credit card balances at once isn’t in your budget, baby steps might still help improve your scores. Often when you pay a credit card balance down by as little as 10%, you may see some positive movement in your scores.

- Review your credit reports for mistakes.

It’s important to keep a close eye on your credit reports to make sure they contain accurate information. Credit reporting errors happen more frequently than many people realize, and those errors could potentially damage your scores.

You have the right to a free copy of your three credit reports once every 12 months via AnnualCreditReport.com (without scores). You can also go to our website (frscredit.com/creditmonitoring) to order an up-to-date, 3 bureau, Identity IQ credit report (with scores) for just $1. If you’d like to review your reports with one of our certified credit professionals, you can also schedule a free credit analysis.

Please join us for the rest of our credit score series. Understanding how your credit scores are calculated is an important step in your journey toward better credit.