Credit Repair That Works: Simple Steps for a Strong Money Future! Everyone needs good credit. A better score means you pay less for loans. It helps with renting a home or getting utilities turned on without big deposits. When your credit is low, everyday things cost more. Missing a payment or having incorrect information on your report can cause your score to drop quickly. That can feel scary and unfair.

This guide will walk you through easy steps to correct mistakes, develop good habits, and utilize local resources. You will learn how to review your report, correct incorrect items, and improve your score over time. Let’s get started with clear advice you can use right away.

Why Good Credit Matters

Your credit score is like a grade for how well you manage your finances. Scores go from 300 to 850. A higher score means lenders think you are safe to lend to. If your score is good, you get lower interest rates. That saves you lots of money on a car or a house. Even insurance and phone plans can cost less when your credit is strong.

Your credit score is like a grade for how well you manage your finances. Scores go from 300 to 850. A higher score means lenders think you are safe to lend to. If your score is good, you get lower interest rates. That saves you lots of money on a car or a house. Even insurance and phone plans can cost less when your credit is strong.

On the other hand, a low score makes life more complicated. You may pay higher rates or be denied a loan. Landlords might ask for a big security deposit. You could spend extra cash just because of one small mistake on your report. Fixing your credit helps you save money and regain control over your life.

What Is a Credit Score?

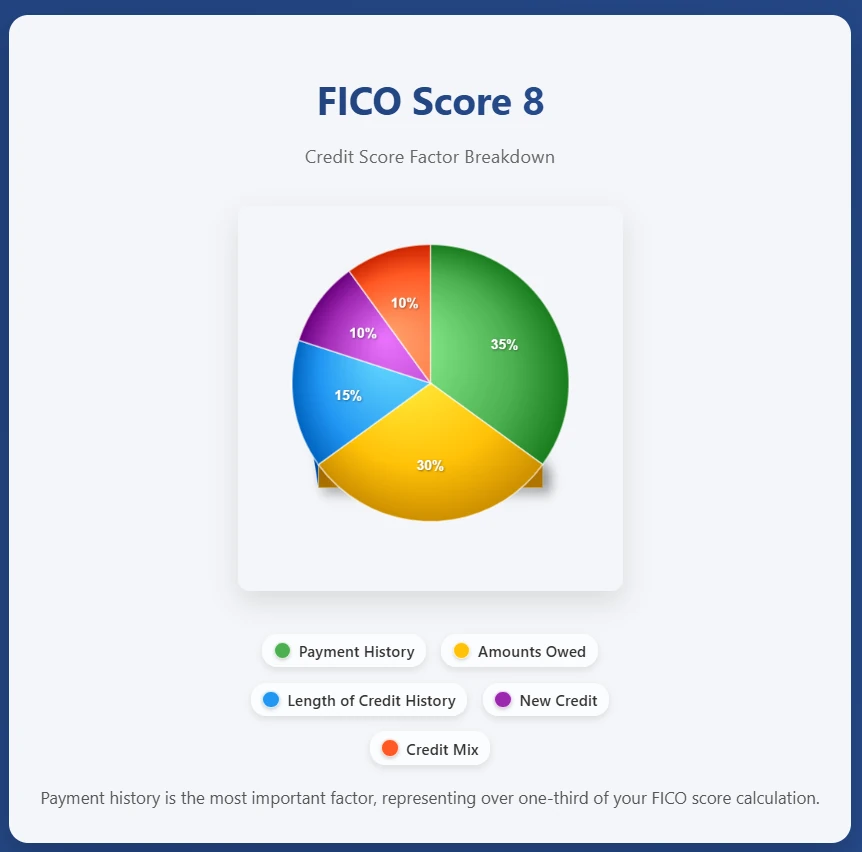

A credit score is derived from your payment history, debt level, and other financial habits. There are two main types: FICO and VantageScore. Both use a range from 300 to 850. FICO looks at your last six months of history. VantageScore can score you after one month. Either way, they check:

- Payment history: Did you pay on time?

- Debt use: How much of your credit limit are you using?

- Account age: How long have your accounts been open?

- Type of credit: Do you have both loans and cards?

- New accounts: Did you open many new accounts recently?

Missing one payment can significantly drop your score. Exceeding your credit limit can also be detrimental. Older accounts and a variety of credit types help your score. Opening many new accounts at once can be a red flag.

Common Mistakes on Credit Reports

Credit reports can have errors. One in five people has at least one mistake. These errors can include incorrect balances, outdated debts, or accounts that are not yours. If a medical bill from someone else shows up under your name, your score goes down for no reason.

In Mesquite, several people have seen this happen. One woman named Ashley found three medical bills that belonged to a different person. She sent proof to the credit bureaus. In six weeks, her score jumped by 84 points. That change allowed her to secure the home loan she wanted.

Checking your report often helps you find these mistakes early. Removing wrong items can lift your score more than any other action.

How to Get Your Free Credit Reports

By law, you can get one free report each year from the three big bureaus: Experian, Equifax, and TransUnion. Visit AnnualCreditReport.com and follow the instructions. During special times, you can even receive reports every week. Look at each report carefully. Check names, addresses, accounts, balances, and payment dates.

By law, you can get one free report each year from the three big bureaus: Experian, Equifax, and TransUnion. Visit AnnualCreditReport.com and follow the instructions. During special times, you can even receive reports every week. Look at each report carefully. Check names, addresses, accounts, balances, and payment dates.

If something looks off, make a note of it. Maybe you see a closed account listed as open. Or a payment you made on time is marked late. Write down each mistake to fix soon.

Fixing Errors Step by Step

First, write a simple letter to the credit bureau that made the error. Keep it short. Say what is wrong and why. Include copies of any relevant proof, such as payment receipts. Please send your letter by certified mail so you have proof that it was received. Then wait up to 30 days. The bureau must investigate and reply. If they can’t prove the information is right, they must remove it.

Do this for each bureau. They do not share fixes with each other. If one removes the error but another does not, send a letter to the next one.

If you still have trouble, you can ask the Texas Office of Consumer Credit Commissioner for help. They investigate complaints about bureaus that fail to follow the rules.

Rebuilding Credit with Good Habits

Correcting mistakes is essential, but establishing good habits is even more crucial in the long run. Start by paying every bill on time. Set up autopay or calendar reminders. Even one missed payment can stay on your report for up to seven years.

Next, watch how much of your credit you use. If you have a card with a $1,000 limit, try to keep your balance under $300 if you can, and pay off the full balance each month. That shows you manage credit well.

You can also mix different types of credit. A small personal loan and a credit card can help. But don’t open too many new accounts at once. Every time you apply, a hard inquiry is recorded, which can temporarily lower your score.

Using Secured Credit Cards

If you have no credit or poor credit, a secured credit card is a good starting point. You give the bank a deposit, say $200. That becomes your credit limit. Use the card for small purchases you can pay off right away. The credit card company reports your payments to all three major credit bureaus. As you pay on time, your credit score will increase. After approximately six months, you may be eligible for a regular card and receive a refund of your deposit.

If you have no credit or poor credit, a secured credit card is a good starting point. You give the bank a deposit, say $200. That becomes your credit limit. Use the card for small purchases you can pay off right away. The credit card company reports your payments to all three major credit bureaus. As you pay on time, your credit score will increase. After approximately six months, you may be eligible for a regular card and receive a refund of your deposit.

In Texas, look for cards with low fees. Check that they report to all three bureaus. Some credit unions in Mesquite offer good secured cards with easy terms.

Trying Credit-Builder Loans

A credit-builder loan works differently. The bank holds the money you borrow in a savings account. You make monthly payments. When the loan is paid, you get the money. Each payment is reported to the bureaus. This shows you can pay on time. Credit-builder loans typically range from $300 to $1,000 and last between six and 24 months.

Local credit unions, such as Mesquite Credit Union and Resource One Credit Union, offer these loans. They often let you pay every two weeks to match your paycheck. Ask about their credit-builder plans if you’re interested in one.

Understanding Your Rights

The Fair Credit Reporting Act (FCRA) is federal law. It allows you to view and edit your report. If you dispute an item and the creditor cannot prove it, the bureau must remove the item from your report. This must happen within 30 days.

The Fair Debt Collection Practices Act (FDCPA) stops debt collectors from calling you at odd hours or using threats. They must send a letter explaining your debt within five days of first contact. You can ask them to stop calling you. They can only call to inform you about legal action or to notify you that they will cease contacting you.

Knowing these rights gives you power. You don’t have to accept wrong information or harsh tactics. Use certified mail and keep copies of everything.

What to Watch for in Credit Repair Companies

You can fix your credit yourself for free. However, some people hire companies to assist them. If you choose a company, ensure it complies with the law. It should not request payment until it has undertaken any work. They must give you a written contract. You have three days to cancel. They cannot promise a specific number of points or a quick fix. FRS Credit Repair does ALL of these things.

Checking Your Credit Often

Even after fixing errors, continue to monitor your reports. Sign up for free monitoring or get your year-end reports again. Look for new errors or signs of identity theft, like accounts you did not open.

Apps like Credit Karma, Mint, or Experian give free score updates and alerts. If something changes fast, you can act right away.

How Late Payments Age with Time

Late payments fall into buckets: 30, 60, 90, and 120 days late. A single late payment can drop your score up to 100 points. The more days late, the worse it hits.

Once a payment is 120 days past due, it may be sent to collections. That stays on your report for seven years from the first missed payment. After two years of on-time payments, the impact begins to soften. Still, the mark stays until seven years pass.

Debt-to-Income Ratio Matters Too

Lenders consider more than just your credit score. They check the debt-to-income ratio (DTI). This is how much of your monthly income goes to paying debts. If your income is $4,000 and your debts are $1,200, your DTI is 30%.

Most mortgage lenders like a DTI below 36%. The FHA allows up to 43%. For other loans, keep the interest rate under 35%. A lower DTI shows you can handle more debt safely.

You can lower your DTI by paying off small debts first or earning extra money. Consolidating high-interest debts can also help reduce your DTI.

Start Today

You don’t need perfect timing. You need action. Here are a few easy first steps:

- Get your three free reports at AnnualCreditReport.com.

- Fix any mistakes you find with a short letter.

- Set up autopay for all bills.

- Pick a secured card or credit-builder loan if needed.

- Sign up for free monitoring to quickly identify new issues.

If you feel stuck, a credit counselor from FRS Credit Repair. We can help repair your credit and put you back on track to prosperity. Your credit score is more than a number. It opens doors. It lowers costs. It brings peace of mind. By taking small steps now, you build a stronger money future. Start your journey today and watch your credit grow.